Summary

How does a functioning credential ecosystem get started? This post looks at MemberPass, the credit union credential ecosystem and explores the strategies credit unions are using to gain broader adoption.

My work in self-sovereign identity began with credit unions. It was March of 2016 and I was having a conversation with Timothy Ruff and Jason Law of Evernym about how difficult it would be to get a multi-sided verifiable credential market going. Timothy's response was "You've got to come to Denver next week!" I showed up at a hotel ballroom in Denver to find almost 100 executives from credit unions all across the US clamoring (no, really) for verifiable credentials. I was hooked.

Over five years later, with a few fits and starts, credit unions are deploying credential-based identification systems for their members. To date, seven credit unions have issued credentials to over 22,000 members or about 2% of the eligible membership of those same credit unions.

Why do credit unions care? One word: fraud. Or maybe two: fraud reduction.

It's All About Authentication

Credit unions and their members face the threat of fraud on all sides. And credit unions employ lots of tools to fight it. But ultimately, the problem comes down to the member and credit union authenticating each other. The problem is that doing this securely annoys people.

None of us like to spend a minute–or more–answering security questions at the start of a customer service call. And SMS-based multi-factor authentication is becoming increasingly fraught. Is that text you just got warning you about fraudulent charges on your credit card really from the credit union? It's hard to tell.

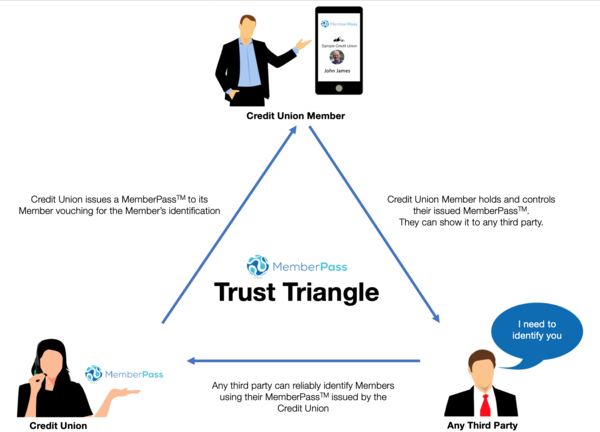

Early on, a few intrepid people in the credit union industry recognized that self-sovereign identity (SSI) offered a way out of this mess. Credit unions are often small and band together to form credit union service organizations (CUSOs) that provide them the services they can't build on their own. They formed a CUSO called CULedger (later renamed Bonifii) to make that vision a reality. Bonifii offers an SSI-based solution for credit unions called MemberPass.

MemberPass allows credit unions to offer their members a verifiable credential that they can use to prove their member number to the credit union. Initially, the MemberPass credential schema is fairly simple, containing only the following attributes:

- CredentialDescription

- CredentialId

- MemberSince

- MemberNumber

- CredentialName

- Institution

Of course, credentials could be much more complicated than this, but this simple schema is sufficient for a member to prove they are in possession of a credential for a specific member number. Members use the MemberPass wallet to connect to the credit union and hold the MemberPass credential.

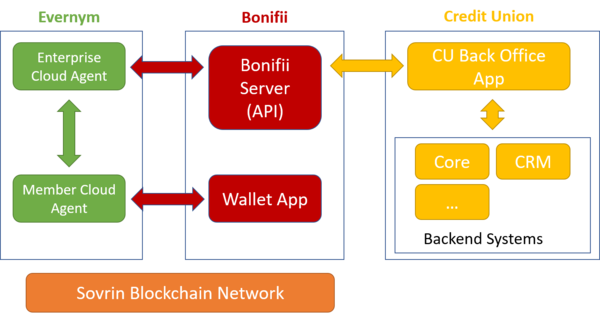

MemberPass relies on Bonifii's partner Evernym for technical services. Credit unions integrate their back office applications with the MemberPass platform at Bonifii which relies on cloud services provided by Evernym.

Growing Adoption

While much of the response to fraud is reactive, MemberPass is proactive. Credit unions work to get members using MemberPass as an active measure to prevent fraud. As I said earlier, to date, seven credit unions have issued credentials to over 22,000 members or about 2% of the eligible membership of those same credit unions. Julie Esser, Bonifii's SVP of Client Engagement expects the number of credit unions using MemberPass to more than double in 2021 and the number of eligible members to jump by almost an order of magnitude.

Increasing the number of credit unions using MemberPass is the first segment in the adoption journey. MemberPass is already integrated with some of the back office platforms that credit unions use, easing the journey. Bonifii is also working with third party integrators to ensure they're technically ready to do the integrations for the rest.

The second segment of the adoption journey is increasing the percentage of members enrolled from the current 2% to 5% and then 10% over the next year. To do that, Bonifii works with credit unions to train frontline staff in the enrollment process. Early enrollments are happening in the branch. But enrollment can also happen on the phone. The phone enrollment process takes 3-5 minutes. The member receives the MemberPass credential while they're on the phone so the call center agent can help with any problems.

First Education Credit Union's President, Jim Yates, says that most new members are signing up. Signing up the larger body of existing members will likely require a move to self-enrollment since many never come into a branch. Self-enrollment is possible within the authenticated context of the credit union's web site. If the member chooses to enroll, they'll be directed to download the MemberPass app and then scan a QR code. This establishes a secure DIDComm connection. The credit union can then make the MemberPass credential offer. UNIFY Financial Credit Union allows self-enrollment now their online banking application.

Once a member is enrolled, the credential can be used in-person at the branch, in the drive-thru lane (with or without interactive teller machines), on the phone, or online. This is not only more secure, but often more convenient as well. For example, someone going through the drive-thru lane can authenticate without passing plastic credentials back and forth. Logging in no longer involves receiving a text and then typing in the code. And calling into the call center no longer requires answering a series of questions of questionable value.

Instead, a push notification on the member's phone asks them to verify they're the one transacting with the teller, call-center employee, or web site. The member clicks "accept" and they're done. Behind the scenes, this is a proof request made through the already established DID connection. By clicking "accept", the member is responding to the request and proving attributes from their MemberPass verifiable credential.

And it's a win for the credit unions too. Desert Financial's EVP Ron Amstutz says it's an important step in reducing fraud. Desert Financial knows they're talking to a member and the member knows they're talking to Desert Financial. Desert Financial is initially recruiting members for the program who call into the call center frequently since that's a big pain point.

Zach Eychaner from 4Front Credit Union says the call center is the first focus for them as well. They are able to shave 30-40 seconds off of each call. With 20,000 calls a year, that time adds up.

The Road Ahead

The MemberPass credential with its limited set of attributes is just a start. The future could include using MemberPass at an ATM or to open account at another credit union. Bonifii's Esser says "Once they get used to MemberPass, members will expect to use it everywhere."

Here are a few things that credit unions could do to make more use of credentials and SSI:

- As we've seen, the current MemberPass schema is very simple–it doesn't even include the members name. A schema with more information in it–information that's been validated by the credit union–would make it usable outside the narrow use case of authenticating the member to the credit union and offer more value to members.

- Credit unions could offer a pre-approval credential for loans that the member could hold and then use when they were ready for a loan.

- Bonifii could issue a credential for KYC use at credit unions, banks, and in other financial transactions.

- Shared branching is a hot topic in the credit union industry right now. Twenty-three thousand branches looks like a mega bank. But the identity fraud problems are even harder to solve across credit unions. MemberPass can help make shared branching a reality.

- Employers and employee groups historically make up the foundation of credit unions. Credit unions could partner with employers to create a credential ecosystem.

- The DIDComm connection is a secure messaging system. Credit unions can use this secure channel for sending notifications to members, or for customer service.

The lessons from MemberPass and the credit union industry are important for anyone launching a credential effort:

- Pay attention to the process and tailor it to your industry. Fraud reduction is the focus. Credit unions are evolving their enrollment process and targeting the parts of the process where they can get the most leverage.

- Start simple. MemberPass is a simple credential but it serves an important purpose: reliably authenticating the member to reduce fraud.

- Plan for the future, but don't get distracted. There are a thousand use cases for credentials in financial services. Get some early wins with your simple "MVVC", minimum viable verifiable credential, before you move on to the rest.

- Stay the course. Building a credential ecosystem is more about human factors than technology. In the words of Julie Esser "The technology is baked." But that's just the start. The MemberPass ecosystem is complicated by regulation, scale, and a decentralized collection of players, each with their own problems and goals. Building an ecosystem in this environment isn't easy, but it's where the reward is.

The Covid-19 pandemic caused credit union branches to close and call center volume skyrocketed and drive-thru lanes were crowded. As a result, fraud also increased. This created a heightened awareness of the importance of digital identity across the credit union industry. But while the pandemic might have pushed things along, many in the credit union industry had already concluded that self-sovereign identity was an answer that was not only flexible, interoperable, and secure, but also one that was aligned with the values of the member-owned cooperatives that make up the credit union industry.